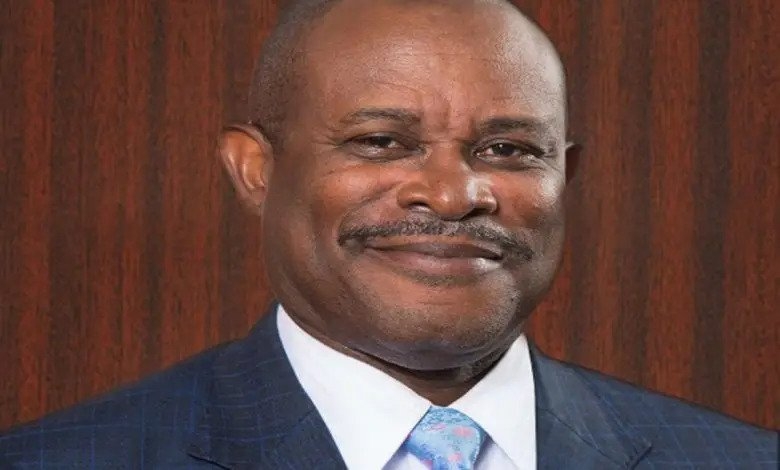

Clearing Banks Association President Kenrick Brathwaite said he believes local banks will start to turn a corner by the third quarter of 2021, after significant losses in 2020 due to increased provisions for loan impairments and rising arrears.

Banks wrote off more than $28 million in delinquent loans in the first quarter of 2021, while loan arrears increased by nearly $23 million (three percent). The quarterly performance comes a year after local banks registered almost $63 million in losses in 2020.

“I mean you would expect that because remember the driving force of the reduction in profitability was the provisions. When you look at the quality of your portfolio, this is what you would expect over a period of time, this is what your provisions are,” Brathwaite said of the losses in the sector.

“So you are making provisions for these things. Whether it be sovereign debt, the reduction in Moody’s rating for The Bahamas had an impact on the overall quality of the debt, so you would make additional provisions for that as well.”

Brathwaite said looking at the financial records of all the banks, the one thing that jumps out is the increase of provisions for loan impairment. The Central Bank of The Bahamas revealed that amount increased 81 percent or $32.9 million in 2020.

“You see that across the board, a significant jump and that it’s probably getting worse because a lot of those persons who were employed previously, we’re not even talking about the natural progression of delinquent loans. During the pandemic there was a large segment who lost their jobs, are no longer employed. Sandals just said their opening will be later than they thought, Atlantis laid off 700 people, so a lot of those factors impacted the figures,” he said.

“So there are a lot of people now who are out of work. Those things would impact your delinquency. A lot of those persons had waivers up until December, but a lot of those have gone into the delinquency bucket, which means that once you become non-performing at 90 days there’s no more income going into the bank. So you have two things, at 90 days those accounts are no longer providing interest and two, you have the provision costs on your entire portfolio. So with those two things the expectation is that there would be a reduction in profits.”

Brathwaite said despite the challenges in 2020, he is optimistic about the banking sector heading into the second half of the year, when he believes improved economic activity will spill over into domestic banks.

Click here to read more at The Nassau Guardian